Services

Our sanctions screening software is designed to meet the rigorous demands of compliance:

Minimise False Positives, Maximise Efficiency

Our software intelligently refines results using advanced algorithms and configurable match thresholds, drastically reducing false positives. This allows your compliance team to focus on real threats, not irrelevant matches, saving time and reducing operational strain.

Centralised System with Seamless Integration

Vertex’s centralised architecture ensures all transactions, messages, and customer records are screened from a single dashboard. Thanks to robust API support, our software integrates effortlessly with core banking, ERP, and CRM systems, automating your compliance workflows across departments.

Robust Sanctions Lists Integration

Our software integrates multiple global and regional sanctions lists to ensure comprehensive screening. This feature automates the cross-referencing process, reducing the workload and improving the accuracy of identifying sanctioned entities.

Real-Time Monitoring and Alerts

Stay ahead of potential compliance issues with real-time monitoring and instant alerts. Our system continuously scans transactions and updates data, providing immediate notifications about any matches with sanctioned entities, thereby enhancing timely response capabilities.

Detailed Reporting and Audit Trails

Our software ensures that you can provide detailed compliance reports and maintain audit trails for regulatory reviews. These reports are designed to track and document all screening activities, providing transparent evidence of your compliance efforts.

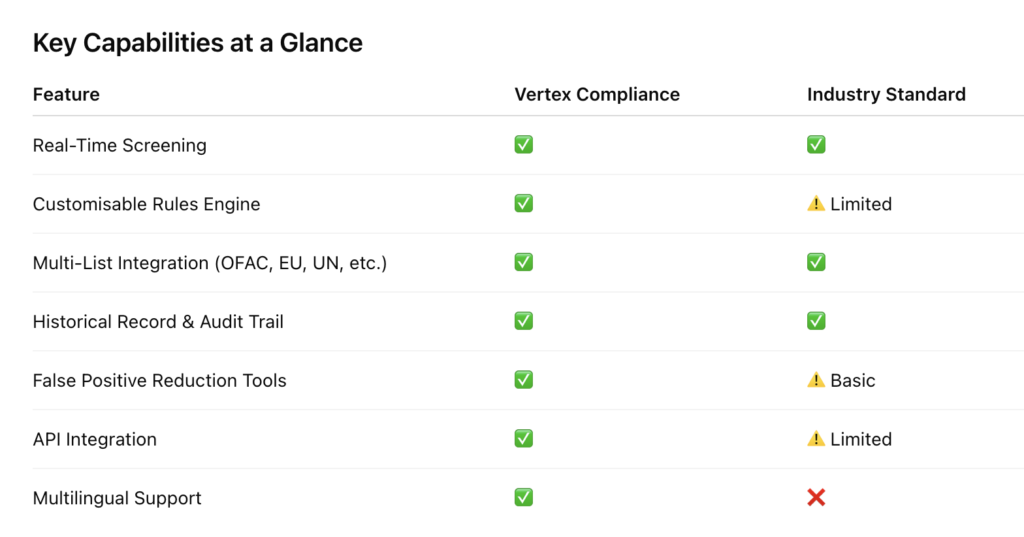

Why Vertex Compliance?

Vertex Compliance ensures your operations are safeguarded against sanctions risks with cutting-edge technology.

Comprehensive Coverage

Our software covers a wide array of sanctions lists and adapts to changes in sanctions regimes, ensuring up-to-date compliance.

User-Friendly Interface

Designed for ease of use, our software enables efficient management of sanctions screening processes without requiring advanced technical knowledge.

Customizable Features

Adapt our software to fit your specific operational needs with customizable features that enhance its effectiveness and integration into your existing systems.

Reliable Support

Our team provides continuous support to address any challenges and ensure your software runs smoothly.

Use Cases Across Industries

Whether you’re a fintech startup, an international bank, or a government entity, Vertex Compliance adapts to your sector-specific screening requirements.

- Banking & Finance: Screen SWIFT, SEPA, and wire payments.

- Cryptocurrency Platforms: Monitor wallet addresses and blockchain transactions.

- Insurance: Vet policyholders and claims against sanctions lists.

- Retail & eCommerce: Screen customers and vendors globally.

Behind the Tech: How It Works

- Automated Data Ingestion:Updates sanctions lists in real time from sources such as OFAC, HM Treasury, EU, and more.

- Intelligent Name Matching: Uses fuzzy logic and transliteration support to handle spelling variations and aliases.

- Risk Scoring Engine: Assigns match risk scores based on entity type, match confidence, and user-defined parameters.

- Audit Logging: Tracks every alert, decision, and override for regulatory transparency.

Compliance That Aligns With Your ESG Commitments

Avoiding transactions with sanctioned entities isn’t just about avoiding penalties, it’s about ethical governance. Our software supports your Environmental, Social, and Governance (ESG) strategy by enabling responsible business practices and supply chain transparency.

Frequently Asked Questions

Gain valuable insights into how our Sanctions Screening Software can streamline your compliance processes and safeguard your operations against sanctions risks with these frequently asked questions.

What is sanctions screening software?

Sanctions screening software automatically checks names, entities, and transactions against global sanctions lists to ensure compliance with AML and regulatory obligations.

Why is timely screening crucial?

Delays in screening can expose your organisation to legal, financial, and reputational risks. Real-time screening enables proactive compliance.

How does our software streamline compliance?

Our platform reduces false positives, centralises data, automates screening processes, and ensures traceability through detailed reporting and audit trails.

Get in touch

To learn more about how our Sanctions Screening Software can help protect and streamline your business operations, contact us. Our team is committed to providing comprehensive support and solutions tailored to your compliance needs.